Identity Protection and Monitoring

Few things in modern life can make us feel as violated and helpless as having our identity stolen and our credit misused by strangers. It’s just so wrong, and yet so elusive. Sometimes we’d almost rather the bad guys just show up in person, preferably wearing stripes and a black mask, walking with their elbows against their stomachs like a T-rex and “sneaking” by bringing their knees up to their chins for every step. Anything seems better than being taken advantage of long-distance by someone you’ve probably never met and may not even be in the same state – maybe not even the same country.

We can at least take steps to protect our homes and tangible property from intruders or thieves. A fancy home alarm system, our two Dobermans, the flamethrower we keep under our pillow – they may not be absolute guarantees against anything, but they certainly make us feel better. But how big does your dog have to be to stop someone from using your Social Security Number to get a tax refund they don’t deserve? What kind of sign do you stick in the front yard to stop someone from buying your credit card numbers and mother’s maiden name on the internet and using it to furnish several apartments?

It can be infuriating.

If you want to prevent credit theft and protect your identity, it’s helpful to know a bit more about how it works. Then, of course, it’s worth considering what you can do about it. Thankfully, it’s easier than you might think.

There are two basic elements to identity and credit protection. While the terms are often used interchangeably, and generally go together, it’s important to recognize the distinction before making a decision about how to best protect yourself from credit identity theft. The first element is credit monitoring. This generally includes a credit score tracker and the ability to quickly analyze changes or unexpected activity to your full credit report with any or all of the three major credit reporting bureaus. The best credit monitoring agencies will alert you when a new loan is taken out in your name or a new credit card opened. They’ll inform you each time a creditor reports that you’re past due or changes your credit limit. If a company checks your credit history, you’ll be informed. If your name appears in court records related to financial judgments, possible bankruptcy, or anything else, they’ll catch it and make sure you know. If questionable behavior occurs and you’re unable to entirely prevent it, some credit monitoring services will help you contact the appropriate creditors, services, or authorities and guide you on restoring your credit. The second element is identity monitoring. Your better id protection companies alert you any time your name, Social Security number, driver’s license number, or other personal forms of identity are used to apply for a loan (even those loans which don’t normally count as “credit,” like payday loans), appear in court records of any sort, show up on change of address requests, add on utilities or other services, or show up on social media or various online sources known to be used by identity theft professionals The best services which protect identity online usually offer some form of identity restoration as well. If your information is misused, they’ll help you with the steps necessary to restore your proper information and alert the appropriate authorities.

Many people assume that if they’re not particularly wealthy and don’t have that many credit cards or other accounts, they’re probable safe from identity or credit theft. That’s not actually true. While bad guys certainly appreciate it if you have easy credit available on your stolen cards or a decent credit rating so it’s easier for them to get their fraudulent accounts approved, it’s not essential. Keep in mind they’re not particularly broken up by high interest rates or other penalties associated with having limited or poor credit. They’re not going to actually pay for any of it, after all. You may wonder if a professional service really does much which you couldn’t do yourself. Before signing up for any sort of identity protection and monitoring, always be clear on what the contract does and doesn’t guarantee. They’re not all the same. At Goalry, we’d rather be honest upfront about a few realities of all ID protection companies and credit monitoring services. The first thing many people don’t realize is that unlike putting armed guards around our property or locking our car in a steel garage, it’s virtually impossible to completely prevent misuse of our personal information. We live in complex, interconnected times. Our information is shared and stored so many different places that those who are determined to get to it have a good chance of eventually succeeding. What we can do, however, is keep some information secure, and to make it much more difficult for the bad guys to get the rest conveniently or easily. Most identity thieves aren’t after us specifically – if our information isn’t easily available, they’ll often move on to the next target. It’s the credit identity equivalents of parking in a closed garage, parking in the street, or leaving the top down and the keys in the ignition. The other thing we can do is catch inappropriate uses of our information in a timely manner in order to minimize the damage and protect ourselves from the consequences. It makes a big difference if you catch an unexpected withdrawal five minutes after it happens instead of five days or five weeks. You wouldn’t have much use for a home alarm system that at the end of the month provided a printout of all the times your windows were jimmied or your smoke detectors noticed something burning.

If you spend any time at all researching the offers of ID monitoring and credit monitoring agencies, you’ll soon notice that a lot of what they offer are things you could conceivably do yourself. Searching court records for your name, analyzing bank and credit card statements for suspicious charges, monitoring your credit reports with the three major credit bureaus, checking to see if there have been any change of address requests filed with the postal service, keeping up with dozens of other database and internet sources – 80% or more of what the best identity theft services offer are things you could do yourself with a laptop and good internet connection. Of course, you’d need to devote several hours a day to the process, every day, seven days a week, 365 days a year, without forgetting anything or getting distracted by other interests or obligations. Then you’d only need professional help for the other 20%. The ability to protect identity online is a combination of innovation and dedication. Professional identity protection and monitoring, for example, may include expert insights regarding various dark web developments and special connections to various databases. These often involve real people and changing circumstances. We probably couldn’t do these parts at home no matter how many hours a day we spent. But they also help to secure your identity by applying specialized technology to do what computers do best – constant, repetitive tasks, day and night, seven days a week, year-round. You can search court records for your name to see if anything unexpected appears. You probably can’t check it at least once an hour, every day, for the rest of your life. Finally, identity protection and monitoring services often offer some form of credit and identity theft insurance as a major element of their identity theft solutions. Like car insurance, this is set up so that you pay a monthly premium in exchange for financial compensation if specific, pre-defined problems occur. Also like car insurance or any other from of insurance, whether or not this is a good idea is all about the specifics. Some offer very reasonable rates and compensation based on their belief they can prevent most problems to begin with. Others essentially charge you to act as a savings account so that if anything bad ever happens related to identity or credit fraud, they’ll reimburse you part of what you’ve already paid them.

Different services and different levels within those services can be called all sorts of different things. Before you sign up for “enhanced identity theft protection” or pay more for “family identity protection plans,” make sure you know exactly what the program does and doesn’t cover, and how it’s different from other versions. While there are several reputable identity theft services out there, you’ll sometimes discover you’re being charged a premium for peripheral services like notifying you when someone on the “sexual offenders registry” moves into a nearby neighborhood or that many of the protections offered are already a standard part of most credit card or banking agreements. As always, pay attention to the details.

Identity thieves and credit cheats have become increasingly advanced in their methods, but so has the ability to resist or overcome them. They’re using the latest technology to take advantage of those of us too busy working and caring for our families and trying to live decent lives to always pay close attention. We can at least counter with the latest technology available to stop them

What if you could protect your identity and fight credit identity theft as easily as you log in to social media or check your email? Imagine a credit score tracker, identity protection and monitoring, and even real time identity theft tips available with a few swipes or a click or two.

Imagine ID monitoring seamlessly integrating with your choice of related financial apps or software, so that your ability to secure your identity worked right alongside your ability to categorize your spending, keep up with your budget, and stick to your long-term retirement planning.

Imagine a misuse of your credit or your identity alert as intuitive as your fitness tracker or built-in camera and as immediate as weather updates or social media notifications. Imagine not having to stop everything you’re doing in order to address credit or identity situations as they arise, but having the option to deal with many of them through the app or software immediately and conveniently.

Imagine building your savings, strengthening your credit, and simplifying your life because what’s yours stays yours. Imagine protecting your money, your information, and your good name from those unwilling to earn any of those things the same way you have – all without sacrificing the other things in your life that matter so much.

Here at Creditry, and across the Goalry family, we understand that managing and protecting your credit and identity aren’t the fun part of personal or small business finance. As with so many financial realities and responsibilities of our modern world, making sure you have the right identity protection and monitoring isn’t always easy, but it doesn’t need to be as complicated as it often seems. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal or small business finances.

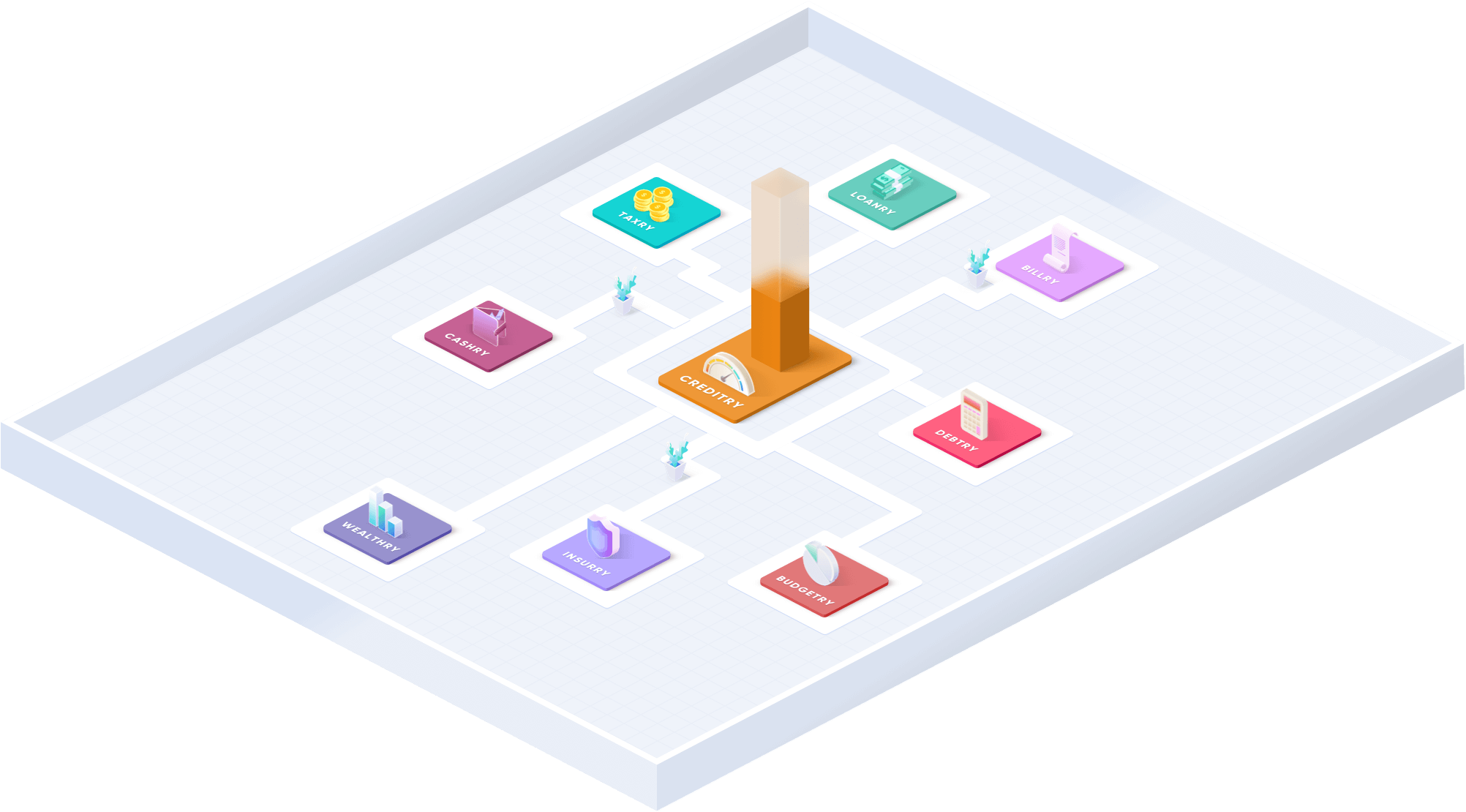

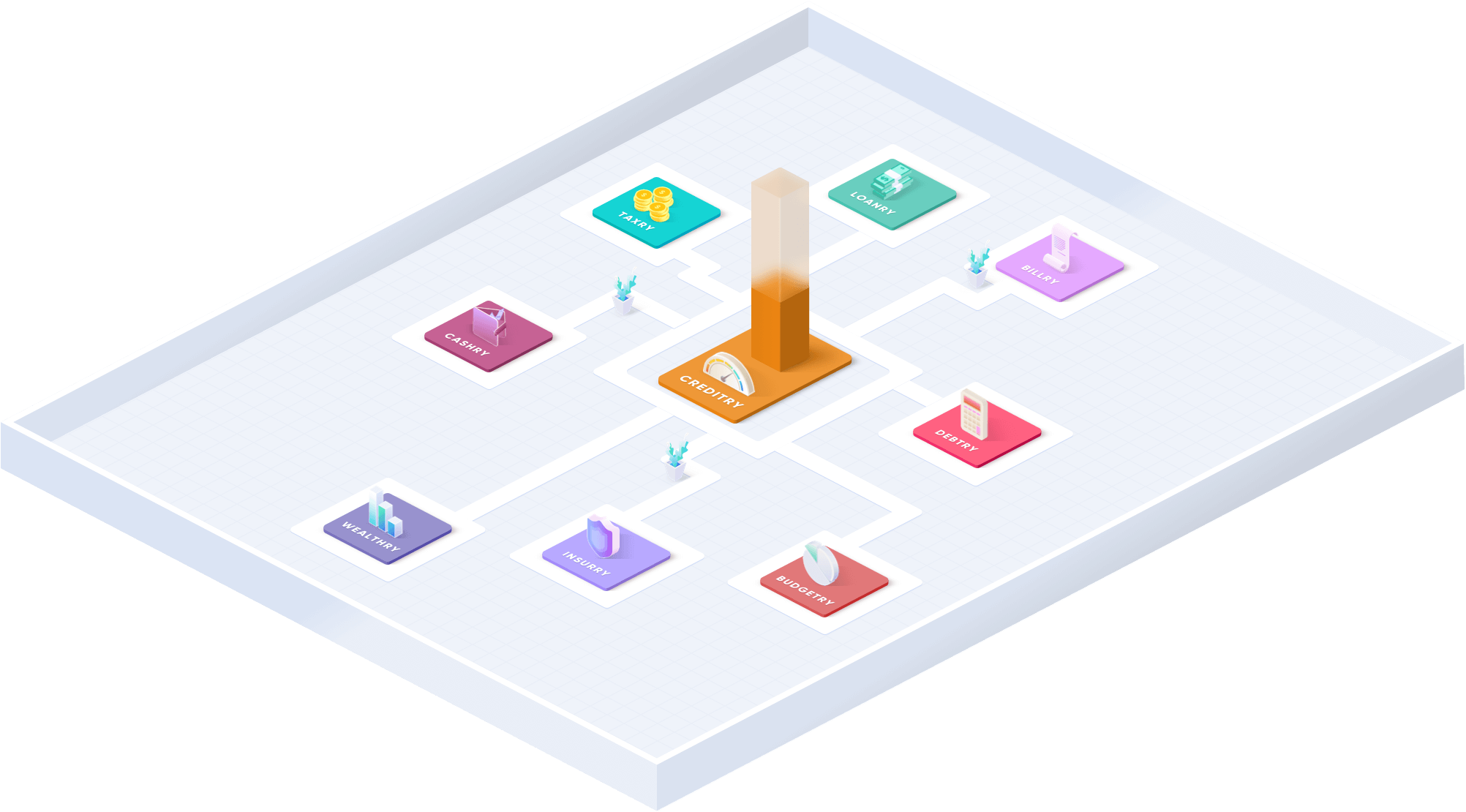

Credit reports, credit improvement, and credit protection are just one small part of the Goalry “finance mall” – ten interconnected sites, each designed to simplify your personal or small business finances. Whether you’re looking for information on how home equity loans work, trying to better understand your taxes, looking for tips on budgeting and cutting down your utilities, or just trying to figure out how to pay off your credit cards and raise your credit score, we’d like to offer our insight and expertise to assist you. Goalry means access, information, and connections to the services you decide you need.

If you found us because you’d like some identity theft tips or you’re comparison shopping family identity protection plans, that’s great. We’re in the process of revising and improving the next generation of identity protection and monitoring – powerful and flexible enough to adapt to your specific circumstances, but intuitive enough for almost any user to master quickly and easily. If that’s all you’re interested in, we’re happy to have you here and hope you’ll sign up to receive immediate notification when we’ve scheduled the precise release date. We’re glad you found your way to us, and we’ll do whatever we can to help while you’re here.

We’d like you to be aware, however, that once you’re a part of any segment of the Goalry family, you automatically have full access to the entire Goalry finance mall. Compare bill consolidation loans with an online calculator at Loanry. Learn how normal people can better invest for retirement with Wealthry. Get connected with professional tax information in plain, simple English at Taxry. Whether you’re interested in real estate, starting a small business, or the warning signs of a which “fast cash” services to avoid, there’s something here for you.

We hope you’ll stick around and explore.