Credit Reports

Your credit report includes information related to your identity and your credit history. If you have or have ever had a mortgage on your home, financed a vehicle, used credit cards, taken out student loans, or had any other form of debt, that information will be included on most credit reports. Your current balances on any outstanding debt is typically included as well, along with occasions on which you’ve been 30, 60, or 90+ days past due on any of these debts.

Obligations like apartment rental or utilities may not be included unless you’ve been delinquent and your landlord or utility companies decide to report this to one or more of the big three credit bureaus. Debts to local businesses or individuals may or may not appear, depending on their policies and which credit bureaus they utilize. This means that while you’ll usually see late payments on credit report results, you won’t automatically see reliable payment histories for services or rentals since they don’t involve loans or purchases on credit. It also means that while most major information will be identical, you may discover minor differences when you get your credit report from different sources.

Bankruptcies, collections, repossessions, etc., are usually included as well, although most negative information “falls off” your report after seven years. While there are many things you can do to improve your credit report, one of the most basic is to simply avoid adding new negative information. Pay your bills. Don’t take out unnecessary loans. Stick to your budget. Only then does it make sense to start focusing on more complicated ways to make your credit record more attractive. (We’ll talk more about improving your credit record below.)

Your credit report also contains identifying information – your full name and any variations or other names you’ve used, your social security number, date of birth, and every known address and workplace. It will not include marital status, race, religion, or other personal information not directly related to identification, although if your spouse or significant other is a co-signer on your mortgage or other loans, their names may show up in those contexts.

Finally, your credit report will include dates and sources of any “hard inquiries” made over the years.

Your credit score is a three-digit number computed from your credit history. There are several versions, but the major ones produce a result between 300 – 850, with anything over 700 being considered pretty good.

Your credit score is a “snapshot” of your credit file – a quick’n’easy oversimplification of how likely you are to make good on new debt.

A “hard inquiry” is documented any time someone checks your full credit history because you’ve applied for a loan or some other form of credit. These occur when you buy a house or finance a vehicle, as well as when you take out a credit card or personal loan. Hard inquiries should never be a surprise because legally they require your signature before they’re submitted. No one should be able to run credit report requests which show up as an effort to secure a loan without your permission.

“Soft inquiries” can be run without your permission and for many different reasons – some beyond the original intent of credit scores and credit reports. Employers may run a soft inquiry before choosing to hire you, presumably as an indication of your reliability. An apartment manager may run a soft inquiry before renting to you. Insurance companies have been known to run soft inquiries before quoting rates to potential customers, offering better terms to folks with a stronger credit history and higher credit score.

Many folks fall into the error of thinking that if they’re not currently planning on taking out a new loan of some sort, they shouldn’t worry about their credit score or current credit report. That’s actually the best time to check your official credit report. It means you have time to understand it, address any errors, and improve it before the next time it’s accessed by someone else.

If you find mistakes on your credit report, you should immediate contact the big three credit bureaus and let them know. The process can sometimes be a bit tedious, but the horror stories you may have heard are not always the norm. The major three credit bureaus pride themselves on being accurate and useful; they want the information to be correct.

At Goalry, you’ll often hear us remind you that “you are not your credit score.” A consumer credit report reflects a series of financial decisions and situations. It matters, and it’s a useful predictor of future behavior in a general, statistical sense. That’s not the same, however, as measuring whether you’re a “good person” or a “bad person” – a “success” or a “failure.” Even an accurate, full credit report is a collection of information and past events. It’s not St. Peter at the Pearly Gates. It’s not final judgment on you as a human being – even if it sometimes feels like it.

That said, it’s important to do what you can to build a strong credit history – raising your credit scores and polishing credit reports a decision at a time. Each of the major three credit bureaus are legally required to provide you a yearly credit report upon request at no charge. Many reputable sites offer access to your credit report online or a full credit report in exchange for considering their services. Make sure you take advantage of everthing that is offered.

Eventually, most of us need credit for something. Someday you may want to buy a home or finance a vehicle. Someday you may want to pay for your child’s wedding. Someday you may want to go back to school or help put someone else through school. In short, very few Americans in the 21st century can live full, relatively normal lives without utilizing some form of credit along the way. When those times arrive, credit scores and credit reports matter a great deal.

Your credit report may determine whether you’re able to buy that home, finance that vehicle, have that wedding, or finish that education. If approved, your credit reports will largely determine what sorts of interest rates and other terms are available to you, and often whether or not you’ll be required to put up collateral – something valuable the lender can take if you’re unable to make your payments. For a mortgage or vehicle, a single interest point one way or the other can mean thousands of dollars over time, and maybe more.

The more you’re paying in interest, the less you have for other things. The better your terms, the faster you’re able to pay off what you owe and the more you’re able to do while paying it off. In short, over time, a strong credit report gives you more options on better terms and greater flexibility with how you live your life. Money isn’t everything, it’s true – but money impacts so many different things which are important to us that it’s still pretty important.

If you’re a small business, your business credit report can impact what sort of financing is (or isn’t) available to you. Vendors may offer different terms based on something as basic as their copy of credit report information related to your business.

Banking no longer consists of Bob Cratchit and Ebenezer Scrooge huddled over ledgers, scribbling in pencil by candlelight. Loans no longer rely on your putting on your Sunday best and humbly petitioning a loan officer in a luxurious building somewhere. Insurance no longer means waiting for someone to show up door-to-door to pile on guilt and anxiety, and investing is no longer limited to wealthy men dressed like the Monopoly guy and smoking cigars in dark rooms together.

In other words, personal and small business financing has changed dramatically in this generation. The weird, wonderful internet, combined with the computing power possible in something as humble as the phone in our back pocket, means access and power like never before even for “real people” like ourselves. Innovation means taking that access and power and making it intuitive and usable without a degree in financial applications.

Imagine the possibilities.

Imagine being notified whenever your credit score changes or your credit report is updated. More and more in the 21st century, our credit is power. Access to home ownership. Gateway to career advancement. Greater flexibility and more opportunities. For better or worse, our credit report is often used to decide how much we’re allowed to experience. We should know exactly what it says, all the time.

Imagine instant alerts if anyone attempts to utilize your credit through false pretenses. Imagine protection against identity theft or other false information related to your credit and your credibility. Most illicit efforts are prevented automatically. If anything suspicious does manage to show up, prompt attention can sometimes make the difference between a minor inconvenience and an extended nightmare.

Imagine the ability to view credit report information or goals as easily as you check your fitness tracker or log in to social media. Analyze your improvement, set new goals, and visualize how different choices would be likely to impact your credit score and credit history over a given time period. It’s a form on unparalleled power over personal information designed to give you back the control you’ve always deserved over how you’re perceived and portrayed to lenders and the larger financial system.

Imagine a virtual partner in protecting, building, and effectively utilizing your credit – all at your fingertips. It’s more than the ability to obtain credit report access quickly and easily; it’s information and insight into your credit file, advice and education about building the best credit report possible. If knowledge is power and time is money, imagine what you could do with both only a few clicks or swipes away.

We have this crazy idea at Creditry, and across the Goalry family, that while money management isn’t always easy, it doesn’t need to be as complicated and scattered as it often seems. We believe that with the right information, tools, and connections, most of us are perfectly capable of taking more effective control of our personal or small business finances.

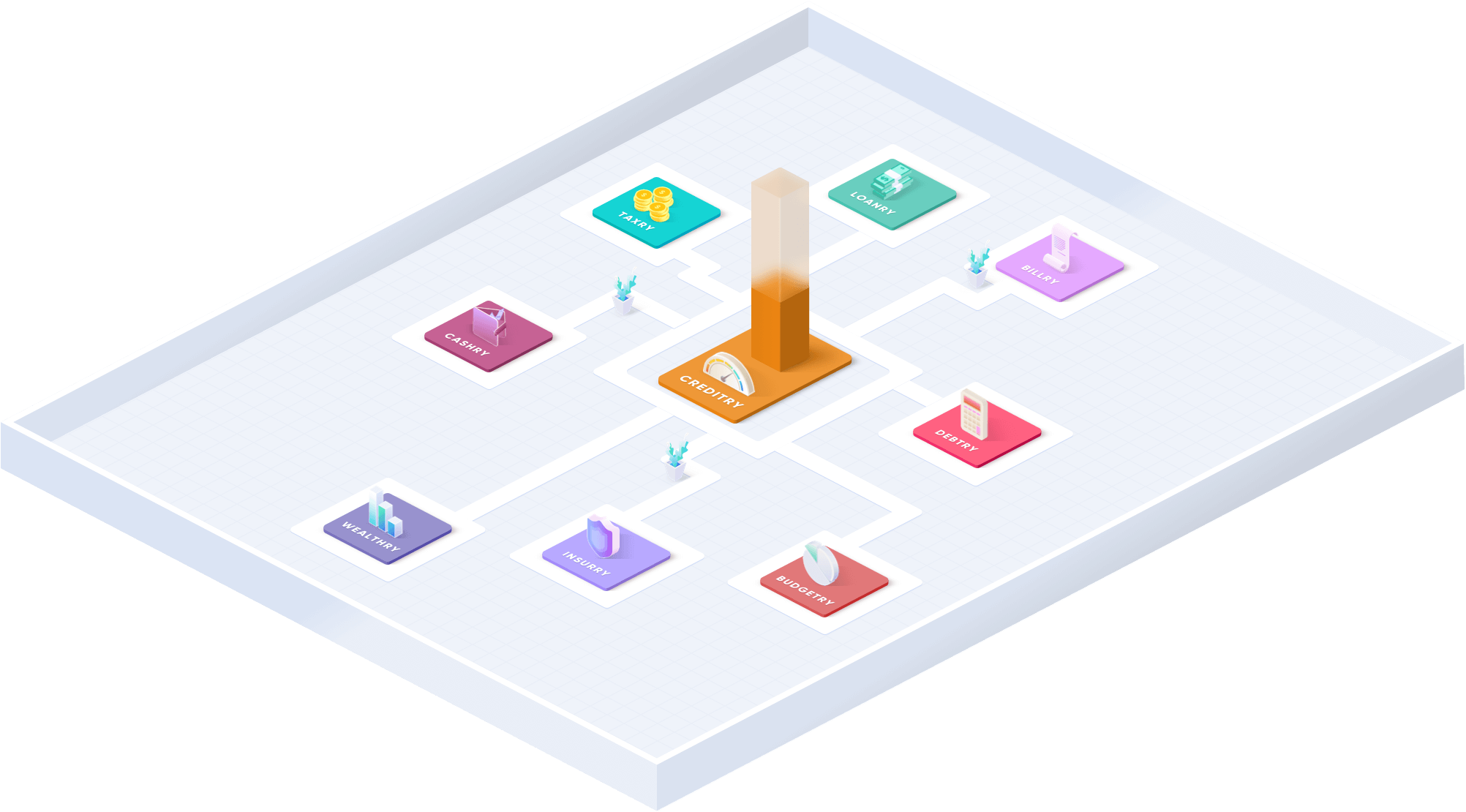

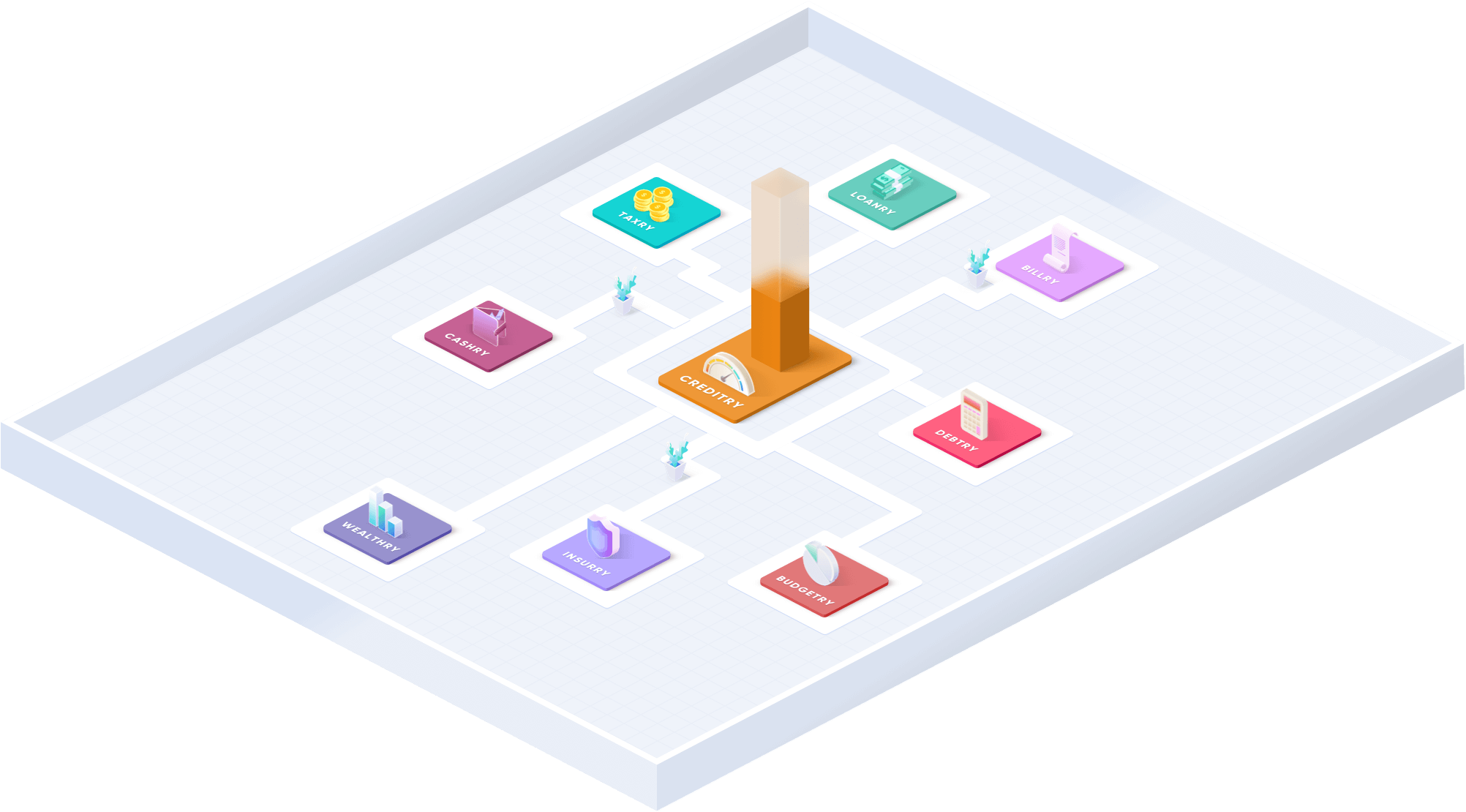

That’s why we’ve created the Goalry “finance mall” – ten connected sites, each designed to simplify your personal or small business finances. Whether it’s budgeting, real estate, debt management, small business taxes, personal loans, or simply checking your credit score and credit report, Goalry means access, information, and connections to the services you decide you need.

At the heart of it all is Creditry. Yes, it’s where you can easily access your credit scores and your full credit report online. It’s where we offer you tools and connections to build, repair, or celebrate your credit history. We’re proud of the overwhelming success we’ve already experienced serving individuals and small business across the country, but our vision is about what’s next.

If you found us because you’re just looking for ways to get your credit report online or want help improving your credit score, that’s wonderful. We’re glad you’re here. There’s plenty here for you to access right now – information, tools, connections. Help yourself. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here.

We want to make sure you know, however, that by taking advantage of the tools and information available here at Creditry, you’ll have access to our sister sites and the information and tools offered by each of them as well. If you’d like to better understand the equity in your home, or how small business loans work, or why interest rates can use similar numbers but produce such different results, well… that’s what we do here. If you decide you’d benefit from a bill consolidation loan, you want more competitive rates on a vehicle loan, or you’d like to comparison shop mortgage options, we can point you some good directions for those sorts of things as well.

It's whatever you need, whenever you need it – as much or as little as you like. Always transparent, always real, always in plain, simple English. That’s the whole idea of an online financial content mall, after all.

Imagine your credit reports and goals integrated seamlessly with whatever other applications you choose to support your savings, investments, budgeting, or other financial goals. You’re still in charge – the technology is a tool to support you and to support your goals.

These are complicated times, and things aren’t always easy. Unified finance doesn’t have to be as difficult as it’s been, however. You don’t have to do things the way they’ve always been done. You don’t have to get the results you’ve always gotten before. And you don’t have to do it alone.

There’s nothing wrong with “bigger,” and we all like “better.” It’s nice to be one of the fastest growing and most celebrated personal and small business financial marketplace providers in the U.S. We prefer to measure ourselves on a different scale, however. We appreciate the numbers we’ve had and the direction we’re going, but what we most want is to serve you. To help you believe. To offer you tools and connections and support to become what you’re meant to be.

Is that a bit idealistic? Perhaps. Does that make it impossible? You tell us.

Let’s get started on that official credit report and what we can learn.